DiWa by Tecnotree

DiWa Intelligent Fintech Platform

Intelligent Fintech Platform connecting people, businesses and money to enable digital lifestyles.

Anywhere. Anytime.

The intelligent solution for forward thinking Service Providers

DiWa is a financial services platform to unlock revenue potential by launching critical payments, fintech products, and services. Built on a fast, secure, and extensible cloud-based microservices architecture from the ground up, DiWa can easily integrate with existing systems or launch a stand-alone digital money operation, leading to the creation of a robust revenue vertical.

The platform with its digital wallet offerings, allows the quick launch of essential payment features like P2P transfer, automatic top-ups, and bill payments. The unified digital experience includes an ecosystem of merchants and partners with QR payments, online commissioning and settlements, and a products marketplace. With Tecnotree DiWa, you can partner with a highly configurable and extensible platform to truly enable the digital economy and customer lifestyle.

Our USPs

SEAMLESS PAYMENTS

Provide an omnichannel payment experience in online and offline channels and offer insights via AI/ML enabled analytics

SECURE

Compliant to PCI-SSF and industry data encryption standards for end-to-end transaction and operations security

LOW-CODE CONFIGURATIONS

Go to market faster with low-code API integrations, dynamic workflows and configurable features

CUSTOMER ENGAGEMENT

Offer loyalty and rewards including those from your partners to create great value in your ecosystem

LIGHTWEIGHT & DEVICE AGNOSTIC

Easily integrate with existing Web and Mobile based platforms or offer stand-alone apps

KEY COMPONENTS

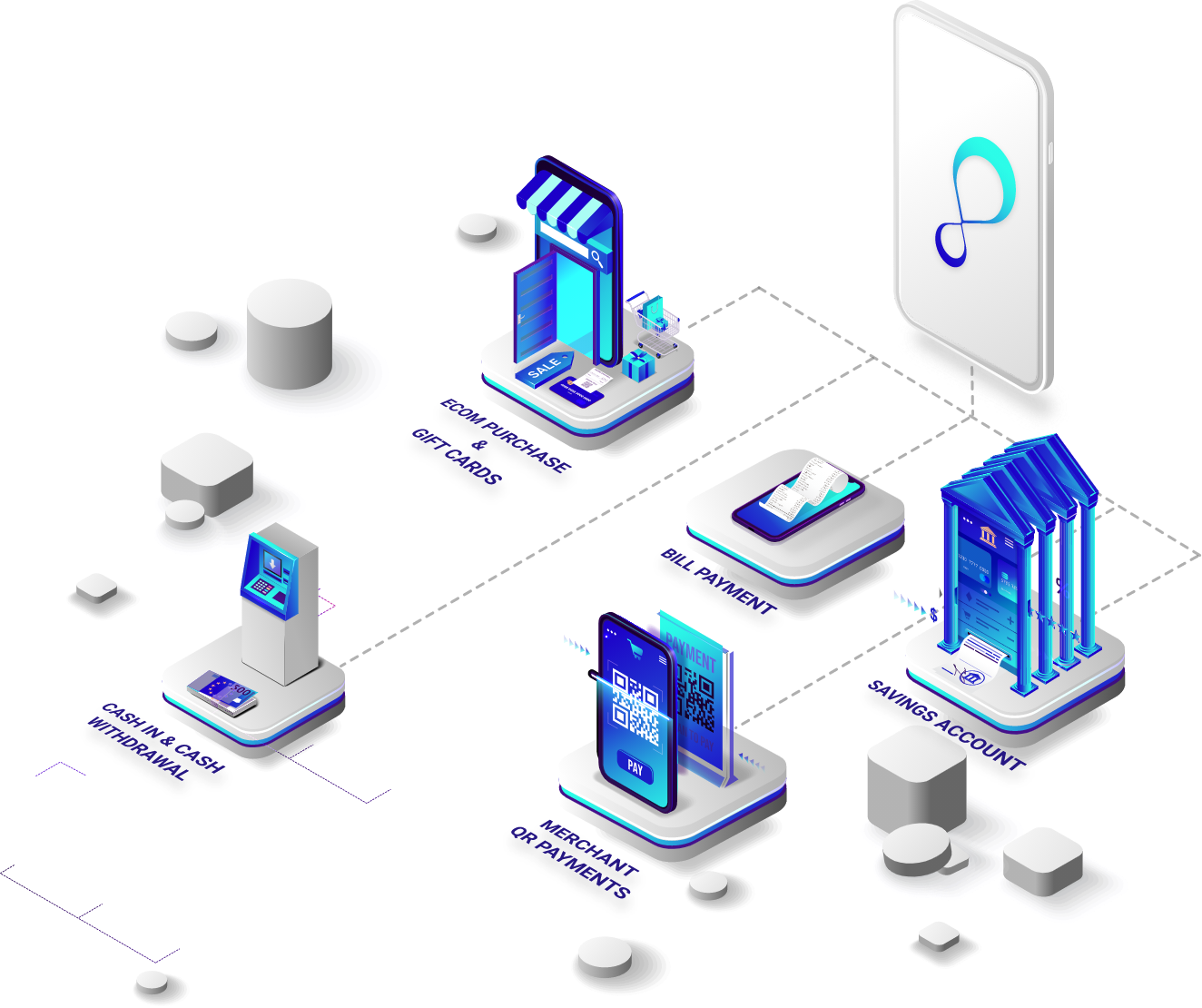

DIGITAL WALLET

Enable a seamless payments ecosystem with end-to-end wallet management solution to serve Customers, Businesses, Partners and Agents

DIGITAL BANKING

Comprehensive fintech layer that can integrate to any Core Banking to provide wide range of financial and banking operations via Mobile and Web apps

SURGE MICROSERVICES ACCELERATOR

Enable DSPs to quickly define and deploy innovative products and services using low code UI, workflows, and smart contracts. These features integrate well with both legacy and digital services on a microservices based architecture with robust API management.

KEY USE CASES

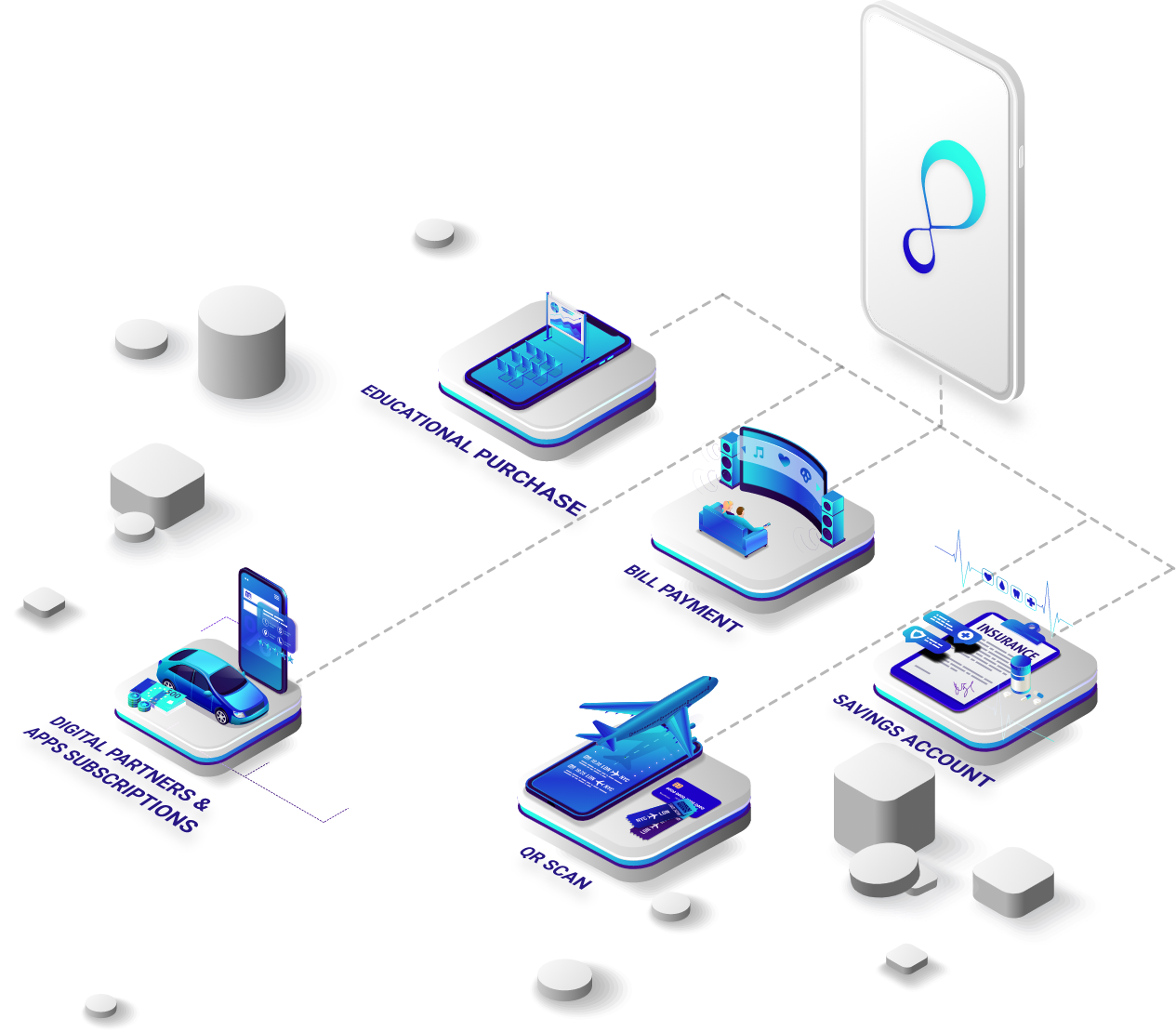

DIGITAL ONBOARDING

Register your customers with a fully electronic KYC process

BILL PAYMENTS

Allow recharges, bill payments like electricity, house rent, internet, etc. Via our e-wallet platform

MERCHANT PAYMENTS

Enable in-store payments via e-wallet, USSD and QR code scanning solutions

SAVINGS ACCOUNT & DEPOSITS

Offer advanced Fintech and Banking services like retail accounts, fixed and recurring deposits, Loans, and Insurance by integrating with appropriate providers

MONEY TRANSFER

Provide Cross border remittances, Peer-to-Peer transfer, and Bank transfer facilities to your Customers

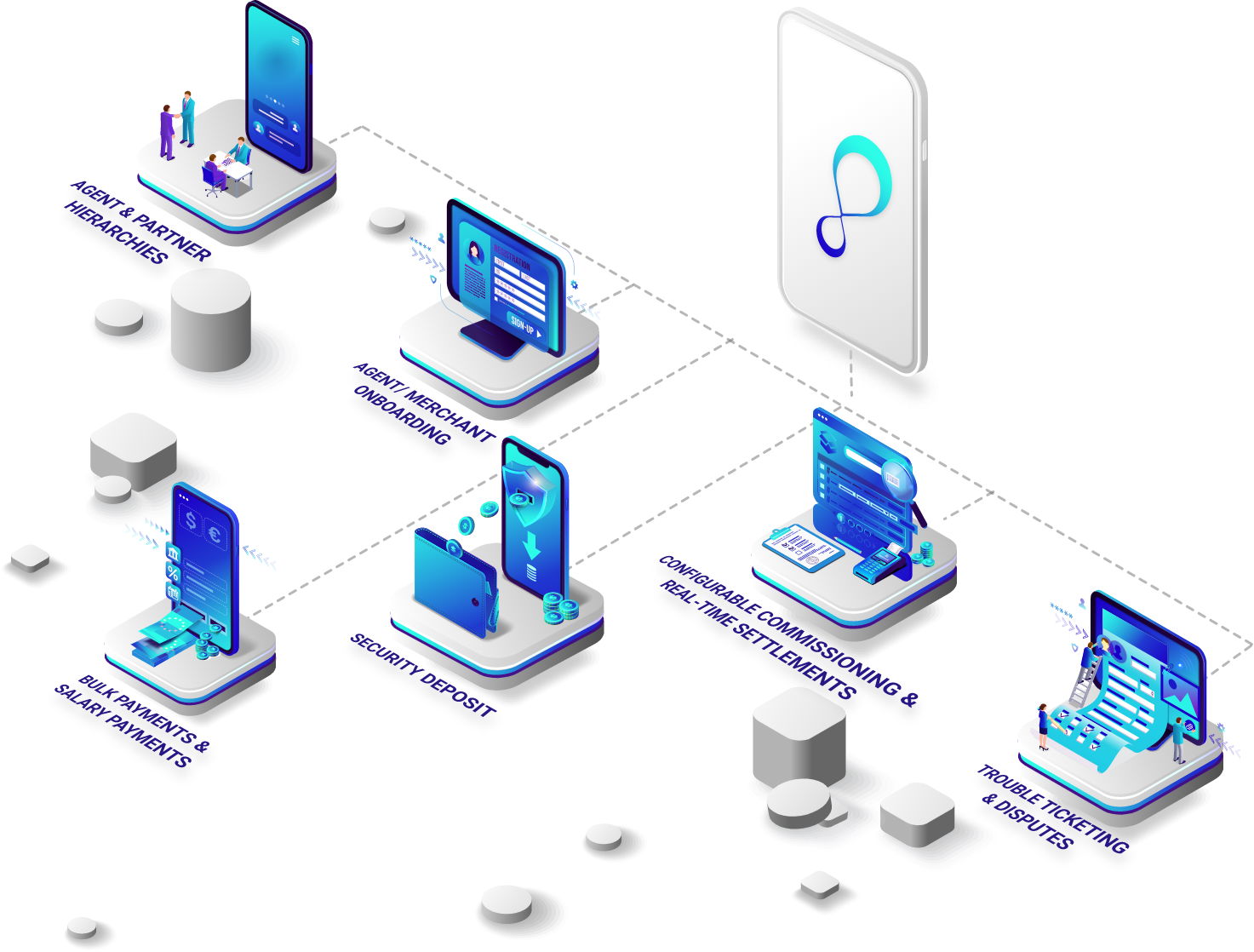

AGENT MANAGEMENT

Manage your agents via services like agent commissioning & settlement, reporting, ratings, and performance analysis

PARTNER MANAGEMENT

Manage partner onboarding, partner product bundling and partner product listing via our Partner management tool

BULK & SALARY PAYMENTS

Bulk Payments – Make payments transfer in bulk for Salaries, commissions, and reimbursements

GIFT CARDS

Facilitating gifting Airtime, Recharges and many other gift cards via Voucher codes service